Financial Planning – Step 1- Define your WHY

The starting point of creating any financial plan is probably going to be the same across the board regardless of which method you use. Most financial strategies and financial experts agree on this step which is to Define your WHY.

Most if not all financial literacy books, authors, podcasts or videos you are going to come across are probably going to advocate for step number one which is to DEFINE YOUR WHY. Defining your why is essentially going to be your guiding compass which will keep you rooted in the execution of your financial plan because believe me it is not easy to stick to.

This is because managing money is typically not intuitive and to make things worse it is not something we are brought up talking about freely. So basically it is a skill that you need to master and acquire.

A Little Background

I have found that in order to be successful financially having a plan has been really cardinal in executing and determining what exactly I’m going to do with my money. This comes from three years of actively managing and controlling my finances as well as five years of tracking my expenses.

Let’s face it everything that we’ve learnt up until probably high school has been the default dream of:

- Get into a university or college

- Get a degree

- Find a job

- Buy a car

- Buy a piece of Land

- Finally, build a house.

- Live Happily Ever After

This is the typical Zambian dream but no one tells us or explains to us exactly how you should execute even this simple Zambian dream because most of the items on the list are going to require money.

For various reasons financial planning and management aren’t taught or stand out as one of the conversations that you need to have as an adult growing up. This is one thing that actually led me to figure out exactly how to manage my finances because I found myself in a situation where I had multiple scholarships and I essentially blew that money within two weeks (Black Friday). It was at that point that I discovered that actually, I wasn’t good at managing money and this proves a very well-known quote:

The more you immerse wealth doesn’t correlate to you being financial literacy.

And that is why after intensive research and active management on my part I highly believe that having a financial plan is essential and cardinal. Having a financial plan is going to answer a lot of questions as far as what to do with the money when you receive it. So let us get started. Let us define your WHY.

1. Introduction to your WHY

The first step in creating a financial plan which is widely agreed upon by most financial experts and literature is establishing a WHY. This step is extremely cardinal as far as creating an anchor to facilitate any decision that you are going make in the future. Your WHY will guide you on how you should handle certain situations. I like how The Budget Mom puts it, “Your WHY should literally get you emotional”. It should either invoke happy or sad feelings, but nonetheless, it should invoke some urgency in you.

Sitting down to write your vision and your WHY on a piece of paper is literally the best step you can take for yourself. It is indeed the first step forward in managing your own money.

2. Tools to Define your WHY

There are no fancy tools that you need in order to execute this step. It essentially requires just a plain piece of paper and a pen where you are simply going to write a short phrase that is going to embody a vision for yourself that will act as a compass throughout your financial journey.

Alternatively, if you have more time and resources. you could also translate that short phrase into a Vision Board. This can be a digital Vision Board or a Physical Vision Board.

3. My WHYs Over the Years

The great thing about defining your WHY is that it can change over time. I have been doing this for three years now and all my WHYs have changed from year to year.

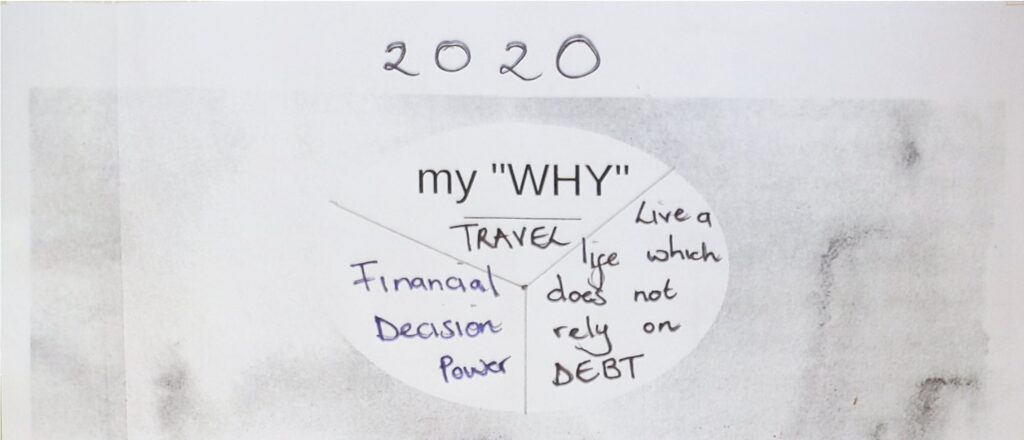

2020 WHY

My 2020 WHY was

Travel and Financial Freedom

Chama Victoria (2020)

Nothing original, just the generic answer that most people use. At that point, I did not know what financial freedom meant to me even though financial freedom is a legitimate reason to embark on your financial journey. The problem with the statement “I want Financial Freedom” is that it is not personal enough because what does financial freedom actually mean? This phrase has so many interpretations for many people. Your upbringing and so many other external factors will influence what “Financial Freedom” means to you. So when defining your why I would like you would actually go deeper.

Questions that you can use in order to answer this a little bit more critically would be:

- Why are you here either reading a blog post about financial planning

- Why are you on YouTube searching for a video about financial planning

- You could be literally doing something FUN with your time, but WHY this topic?

What reason has propelled you to stop whatever it is that you are doing to seek some answers about managing your money effectively? That first thought that pops up in your head is probably a great starting point to reveal your WHY.

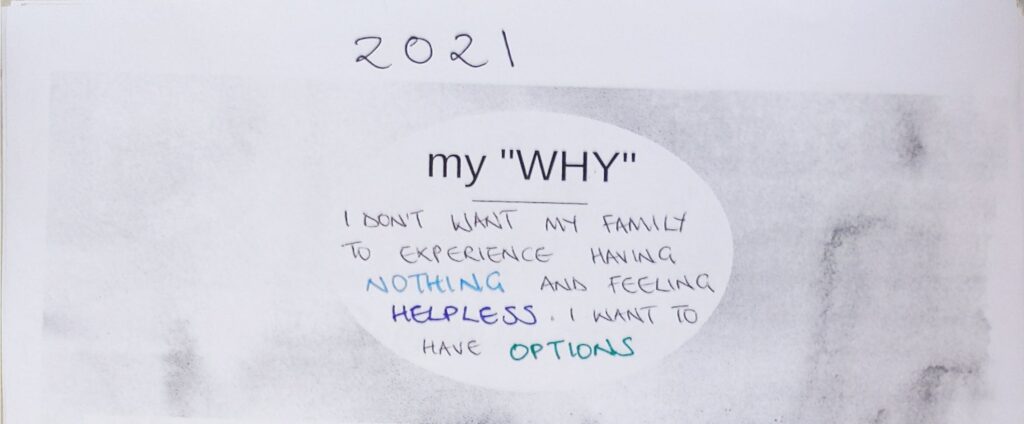

2021 WHY

In 2021 my new WHY was:

I do not want my family to experience having nothing and feeling helpless. I want to have options.

Chama Victoria (2021)

In 2021, my WHY changed to something more personal. At that time I was transitioning from a mindset of scarcity to abundance. Initially, the reason I embarked on my financial journey was scarcity. I was scared of not having enough and that was my driving force at the time. Throughout the whole of 2021, my focus was to create financial stability through writing budgets, continuously tracking my expenses and establishing sinking funds and savings. This WHY was enough to drive me to actually save my money and not deep into my savings on a regular basis.

The more personal you get with your definition of “Financial Freedom”, the more likely you will stick to your goals and habits.

This WHY changed from the 2020 generic “Financial Freedom” to something more specific that kept me motivated.

2022 to date WHY

My current Why is

Create a Rich life full of ABUNDANCE without limitations for myself and my family

Victoria Chama (2022)

Then moving forward into 2022 my WHY became different and that was creating a rich life full of abundance without limitations for myself and my family. At this point in my financial journey, I have “mastered” the skill of budgeting, tracking and also saving and I was slowly transitioning into investing. This means my anchor or campus has also changed.

My vision and WHY at the beginning of the year was “ABUNDANCE” and that was what I felt was necessary for me to keep on going on my financial journey and keep repeating all these habits day in and day out month after month.

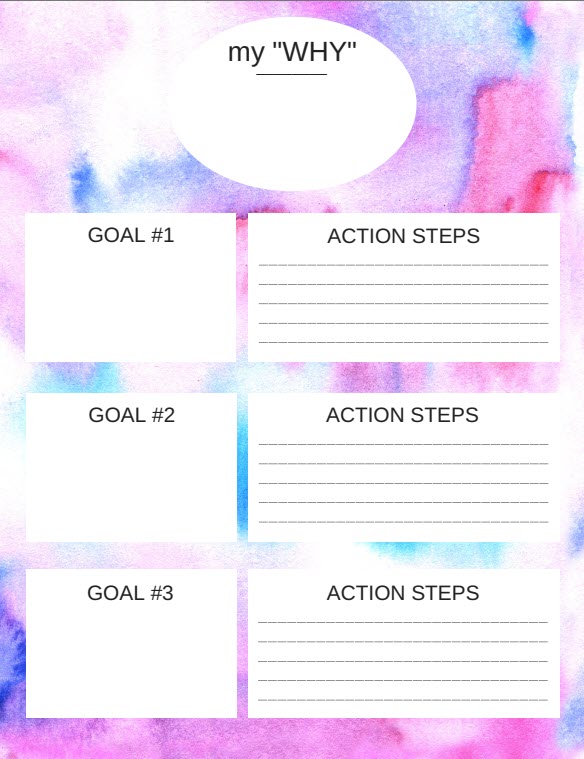

4. Resources You Can Use

Every single year I have done this exercise I have used the worksheet by The Budget Mom. It is absolutely free and all you have to do is sign up for her newsletter which also gives you access to her very generous FREE Resource Library. After defining your WHY, the bottom part of the worksheet allows you to specify 3 main goals that you want to work on in order to get you closer to your financially free life.

5. Actionable Tasks

Now for the fun part, at the end of each blog post in this series, I will highlight actionable tasks that you need to do in order to make all of this more concrete. Reading a blog post about defining your WHY is one thing. Actually doing the work is another and that is what will make a difference.

Step 1- Define your WHY Task

The following are the tasks that you need to complete. After you finish a task, you can tick it off just to help you keep track of what you have done and what else is pending.

So in the comment section, I would like each one of you to Define Your WHY in a few lines maybe a sentence or two and elaborate on what that means to you moving forward I wish you all the best in your financial journey and good luck.